Planned giving

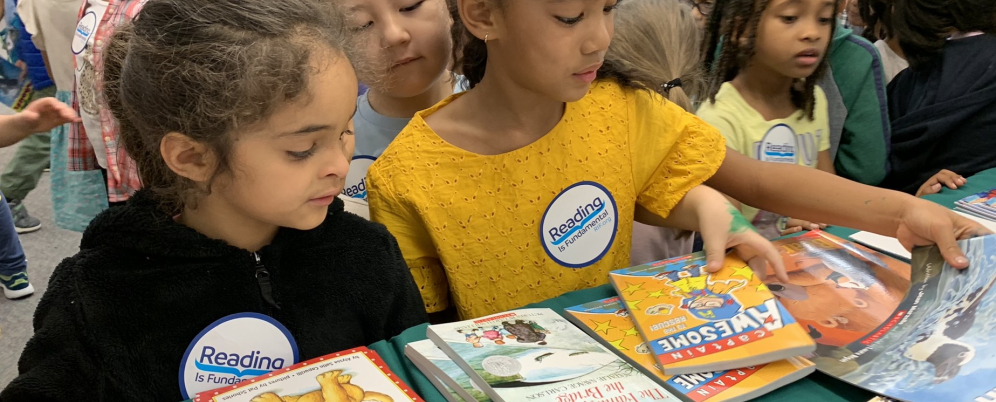

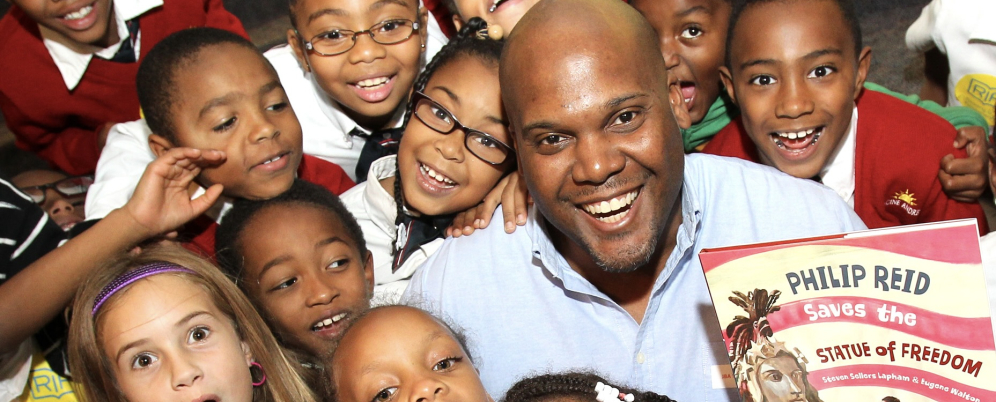

When you incorporate Reading Is Fundamental in your estate plan, your commitment to literacy lives on by inspiring the joy of reading among all children and giving every child the fundamentals for success.

Make a plan to increase your impact

There are several ways to include RIF into your estate plans, including but not limited to the following:

Bequest: A bequest is a gift made through a will or a living trust. It is the most popular planned gift, the easiest to make, and it costs nothing during your lifetime.

Life Insurance: You can designate RIF as a life insurance policy beneficiary. When the time comes, RIF receives the proceeds.

Retirement Plans: Like a gift of life insurance, you can name RIF as the beneficiary of a portion or all of your IRA, 401(k), or other retirement plans. When your estate is settled, the amount designated passes to RIF, and your heirs avoid income and estate tax.

IRA Rollover: A Charitable Individual Retirement Account (IRA) Rollover (also referred to as a QCD — a qualified charitable distribution) allows you at 70½ or older to make tax-free IRA charitable rollover gifts of up to $100,000 per year directly from your IRAs to RIF. The funds must be transferred directly to RIF; withdrawing them first will result in a tax penalty.

Reading Is Fundamental

750 First Street NE, Ste 920

Washington, DC 20002

Tax ID# 52-0976257

Please see our easy guide to bequest language to get you started.

If you are interested in learning more, please contact our Laura Rahman via email at lrahman@RIF.org or phone at 202-536-3515.